The supernatural thriller ‘Exhuma’ has succeeded in capturing the attention of movie enthusiasts in Indonesia. Since three weeks of screening in local theaters on February 28, the film, which tells the story of supernatural conditions, shamanic rituals, and mysteries in tradition, has managed to attract 1.1 million viewers in Indonesia.

The Exhuma tells the story of a wealthy family who experiences a terrifying supernatural terror from their ancestors. This terrifying terror prompts them to seek help from a famous young shaman.

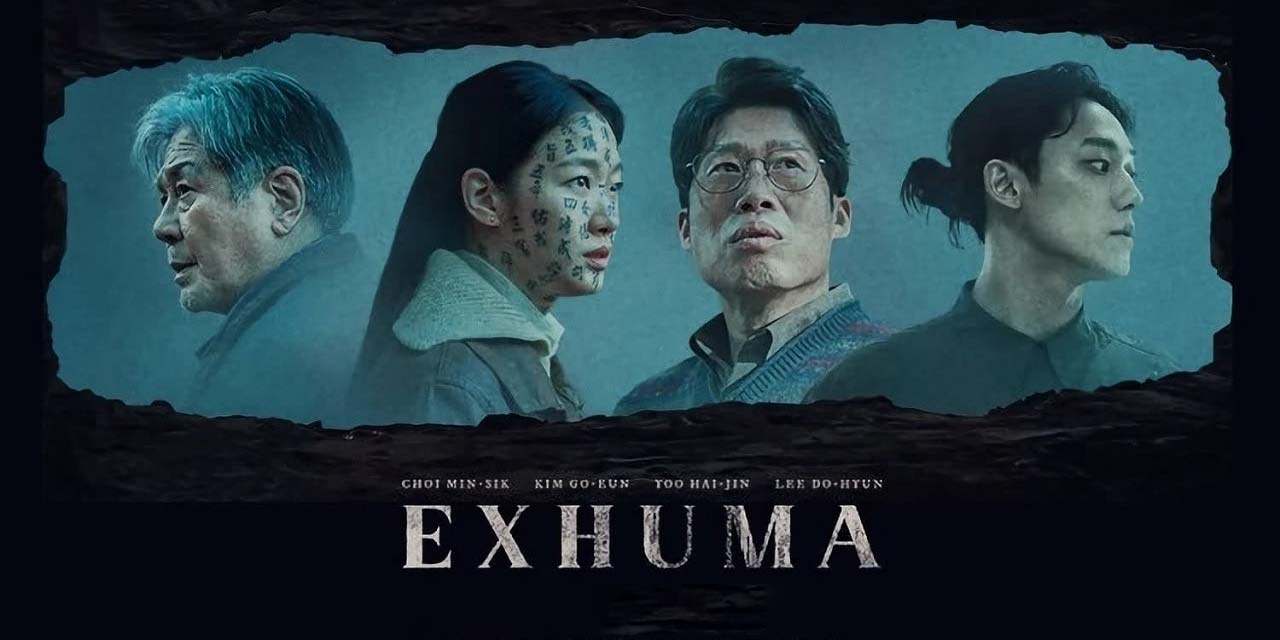

Namely, Lee Do Hyun (Bong Gil) and Kim Go Eun (Hwa Rim). If the two succeed in stopping the mysterious source of the threat, they will be paid an enormous reward. Rituals are then performed to ward off the evil attacks on the family. Two shamans, a feng shui expert and a cemetery worker, work together to investigate a series of mysterious events affecting the US-based wealthy family.

Kim Go Eun’s role as a young shaman named Hwa Rim has the capacity to perform exorcisms. Choi Min Sik’s role as a Feng Shui expert named Kim Sang Deok will assist Hwa Rim and Bong Gil. Yoo Hae Jin’s role as a cemetery worker named Young Geun, an expert in choosing burial sites.

However, it becomes increasingly clear that the disturbance is far greater than they suspected. The four of them see something suspicious as soon as they see the graves of their client’s ancestors, where she is interred in a cursed pit, which, if dug and explored deeper, will bring more danger to the shamans.

The film becomes even more attractive when discovering other facts, leading to a more complicated problem. However, there is an exciting aspect behind this film. The young shamans, Hwa Rim, and Bong Gil, are paid very highly by wealthy families in America. They even travel by business class flight.

From a tax perspective, Hwa Rim and her colleagues are paid handsomely to resolve the terror they experienced. If Hwa Rim and Bong Gil were Indonesian citizens, how would the tax aspects of their income as shamans be treated?

Tax Aspects of Shaman Profession

As shamans, Hwa Rim and Bong Gil will be subject to Income Tax using the net income calculation norm/NPPN. NPPN is a guideline for determining the net income amount to determine the tax payable.

As is known, by the provisions of Law No. 36 of 2008 concerning General Provisions and Tax Procedures (KUP), every individual and corporate taxpayer carrying out business activities or freelance work is required to maintain bookkeeping.

Thus, income tax calculation uses the method according to Article 17 of the Income Tax Law No. 36 of 2008 as amended by Law No. 7 of 2021 concerning Harmonization of Tax Regulations (HPP) and its implementing regulations.

However, individual and corporate taxpayers who cannot maintain bookkeeping with gross income criteria of less than IDR 4.8 billion per year can keep records and are allowed to use the NPPN method to calculate their tax obligations. So, the NPPN method aims to simplify the calculation of net income for certain taxpayers, which cannot be calculated based on other calculation methods to obtain their payable income tax.

The use of NPPN is also technically regulated in the Regulation of the Director General of Taxes No. PER-17/PJ/2015 concerning Norms for Calculating Net Income. In this implementing regulation, the NPPN percentage is determined based on their respective regions and business fields to calculate the amount of the taxpayer’s net income.

Referring to PER-17/2015, taxpayers are allowed to use NPPN under the following conditions: annual gross income below IDR 4.8 billion, which is required to maintain records, and income earned is not subject to Final Income Tax. It must notify the Directorate General of Taxes (DGT) three months from the beginning of the relevant Tax Year to use NPPN.

As a simulation, if Hwa Rim and Bong Gil are Indonesian citizens and practice shaman activities in Jakarta, then by Appendix I of PER-17/2015, the income norm imposed on Hwa Rim and Bong Gil is 29 percent with the business field classification code 86902 Traditional Health Care Services which includes traditional physical health care and treatment carried out by shamans, traditional healers, shines and the like.

So if the income received by Hwa Rim is IDR 1,000,000,000, and currently Hwa Rim is not married and has a non-taxable income (TK/0) of IDR 54,000,000, then the income tax payable is the gross income multiplied by the NPPN (29 percent), so the net income is IDR 290,000,000. Then, the net income is reduced by the non-taxable income of IDR 54,000,000, and the taxable income is IDR 236,000,000.

The taxable income is then multiplied by the income tax rate under Article 17, so the progressive rate for the first layer of 5 percent multiplied by IDR 60,000,000, resulting in a tax of IDR 3,000,000, plus a 15 percent rate multiplied by IDR 176,000,000, resulting in a tax of IDR 26,400,000, so the total income tax is IDR 29,400,000.

In addition to being obliged to report the Annual Tax Return by March 31, Hwa Rim and Bong Gil must also submit notification of the use of NPPN for the current year. Currently, the submission of notification of the use of NPPN can be made in 4 ways, namely electronically, which consists online through the official DGT Online website, through the Contact Center, directly to the KPP/KP2KP where the Taxpayer is registered, or by post with proof of sending the letter.

Taxpayers who wish to use the income calculation norm must first submit a notification to the Directorate General of Taxes within the first three months of the relevant tax year as regulated in the Income Tax Law.