A Stimulus with Strategic Implications

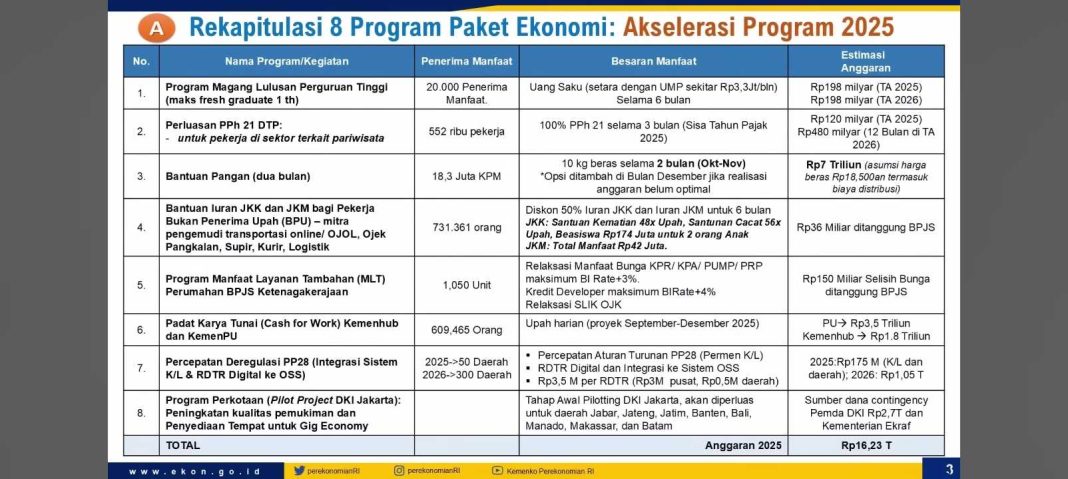

When President Prabowo Subianto announced the economic stimulus package dubbed “8+4+5” in mid-September 2025, the nation’s attention was immediately drawn to its scope and ambition. The package consists of eight acceleration agendas for the remainder of the year, four follow-up agendas in 2026, and five special programs to absorb labour. It appears to be a temporary answer to the looming global slowdown —a bid to sustain purchasing power, stabilize employment, and reduce the strain of tightening global trade.

Yet beneath the macroeconomic framing, there lies a more sectoral question: what does this package mean for Indonesia’s aviation industry? For an ecosystem battered by the pandemic, weighed down by rising fuel costs, disrupted by geopolitical turbulence, and perpetually constrained by limited maintenance capacity, the arrival of 8+4+5 is not just fiscal news. It could be a turning point—or another missed opportunity.

The crux of the matter is simple: can 8+4+5 be translated into structural capacity-building rather than merely short-lived consumption? For aviation, the stakes are existential. Without careful alignment, the stimulus will generate more passengers, but without the infrastructure, skilled manpower, and operational resilience needed to serve them sustainably. With alignment, however, the package could fuel not only recovery but transformation—turning Indonesia from a reactive player in global aviation into a proactive, competitive hub.

Consumption vs. Capacity

Much of 8+4+5 is demand-side in character: wage subsidies, social assistance, tax relief for tourism and hospitality workers, and incentives for travel-related consumption. These measures will undoubtedly put more people on planes. Indeed, Indonesia’s experience shows that even modest fiscal nudges can rapidly translate into higher air travel, especially for domestic tourism.

But demand-side stimulus alone is a fragile tool for aviation. If passenger numbers surge without adequate aircraft, trained crew, ground infrastructure, or maintenance capacity, the outcome is predictable: bottlenecks, delays, higher operating costs, and fraying consumer trust. Aviation is not a simple consumption-driven sector. It is capacity-driven—its efficiency and safety depend on how well supply-side investments match demand-side growth.

Thus, the real test of 8+4+5 lies in whether it becomes a tool for structural capacity-building: certified human resources, independent and modernized MRO (maintenance, repair, overhaul) facilities, resilient fuel supply chains, and integrated logistics platforms. Unless the package channels resources into these supply-side pillars, its impact will fade as quickly as a promotional fare.

Demand Drivers: Tourism and Domestic Mobility

A central feature of the package is fiscal relief for the tourism sector: tax incentives for hospitality workers, subsidies to support low-income households, and regional grants to revitalize tourism nodes. The expected result is a sharp rebound in domestic travel demand.

Data suggests that for every 10 percent increase in tourist arrivals, domestic air passenger traffic rises by 6–7 percent. If 8+4+5 delivers even half its intended tourism boost, airlines—particularly low-cost carriers (LCCs)—will face immediate spikes in bookings to Bali, Labuan Bajo, Mandalika, Yogyakarta, and other priority destinations.

On the surface, this is welcome news. For carriers still struggling with pandemic-era debt, higher load factors promise better cash flow. For airports in tourist regions, higher throughput could accelerate regional development.

But the system’s fragility looms large. Airport slot allocations remain tight, particularly at Soekarno-Hatta and Ngurah Rai. Ground handling operations are already stretched thin. And if tourist arrivals stay concentrated in main hubs, congestion will only get worse. Demand will grow—but can supply keep up?

The Workforce Challenge

One of the boldest elements of 8+4+5 is its emphasis on employment absorption. Paid internship schemes, wage subsidies, and vocational training incentives are designed to integrate young workers into industries like aviation.

For aviation, this could be transformative. Indonesia faces a chronic shortage of certified technical personnel, particularly MRO engineers. ICAO estimates that the Asia-Pacific will require over 300,000 additional certified technicians by 2035. If Indonesia leverages the package to fund certification-based training pipelines, it can secure a domestic workforce capable of meeting both national and regional demand.

The danger, however, lies in execution. Without strict competency standards, internship programs risk degenerating into little more than cheap labour subsidies. Interns may cycle in and out of airports and airlines without gaining the certifications needed to advance their careers. For an industry where safety depends on competence, that is unacceptable.

Thus, the government must impose conditionality: subsidies should only be disbursed when internships culminate in recognized certifications—whether ICAO, EASA, or Indonesian DGCA standards. Only then will the package strengthen, rather than dilute, aviation’s human capital.

The Twin Structural Bottlenecks

The weak spot in Indonesian aviation is maintenance, repair, and overhaul (MRO). Even with one of Southeast Asia’s largest fleets, much of the heavy maintenance is still sent overseas—to Singapore, Malaysia, and beyond. This drains foreign exchange, reduces competitiveness, and denies the domestic economy its multiplier effects.

Within the 8+4+5 framework, MRO barely registers. Most stimulus funds lean toward consumption rather than industrial strength. Without policy correction, Indonesia risks repeating the paradox: demand rising, while high-value services are outsourced abroad.

A similar weakness lies in aviation fuel. Volatile prices, amplified by geopolitics, keep airline costs high. Global benchmarks may ease, yet Indonesia’s avtur remains costly—burdened by distribution gaps and limited refining capacity. Without targeted investments in refining, storage, and distribution, airlines stay vulnerable to external shocks.

Unless 8+4+5 is recalibrated to address these supply-side fundamentals, aviation will remain reactive—growing in booms, shrinking in downturns, never truly resilient

Unlocking Value Chains

Another dimension of 8+4+5 is its focus on UMKM and export promotion. Tax relief and credit schemes are designed to support small businesses, particularly those producing value-added goods for export. This is where aviation—specifically air cargo—enters the frame.

Indonesia’s export competitiveness in perishable and high-value goods (seafood, pharmaceuticals, electronics) is heavily dependent on efficient air cargo. Yet current bottlenecks in cold storage capacity, customs procedures, and multimodal integration limit growth. Even as UMKM receive incentives to produce, the logistics system struggles to move goods efficiently from hinterlands to international markets.

Here, aviation stimulus must be explicitly logistics-linked. Building cold storage at secondary airports, streamlining customs clearance, and integrating multimodal hubs could unlock significant cargo growth. Without this, 8+4+5 will generate production potential without the logistical arteries to carry it abroad.

Aligning Stimulus with Aviation Transformation

To maximize the aviation dividend of 8+4+5, five policy recalibrations are essential:

- Competency-Based Internship Subsidies: Tie paid internship subsidies to certification outcomes. Only participants who complete recognized technical training (MRO, flight operations, ground handling) should qualify for government support. This ensures that labour absorption translates into skill accumulation.

- Regional MRO Investment Funds: Dedicate a portion of the stimulus to co-invest in regional MRO hangars through public-private partnerships. Indonesia should not remain dependent on foreign facilities for heavy maintenance. Domestic MRO expansion would create jobs, conserve foreign exchange, and elevate national aviation sovereignty.

- Secondary Airport Incentives: Couple tourism subsidies with landing fee reductions at secondary airports. This encourages airlines to open new routes, distributes tourist flows, and relieves pressure on overloaded hubs.

- Integrated Cargo Ecosystem: Establish stimulus-backed logistics hubs that link UMKM exporters directly to air cargo networks. Investment in cold storage, customs simplification, and multimodal integration is critical to convert production incentives into actual export flows.

- Performance-Based Monitoring: Adopt quarterly KPIs for aviation stimulus: number of certified aviation professionals produced, MRO capacity added, reduction in maintenance outsourcing, and growth in air cargo tonnage. Without measurable benchmarks, the package risks dissolving into populist expenditure.

Aviation as a Sovereignty Issue

It is tempting to treat aviation merely as a service sector, tied to tourism flows and consumer demand. In truth, aviation is a matter of sovereignty. A nation unable to maintain its own aircraft, fuel its fleets efficiently, or train its technical workforce will always be at the mercy of external shocks.

The pandemic, the Russia–Ukraine war, and Middle East tensions have all exposed just how brittle global aviation supply chains can be. Indonesia must draw the lesson: resilience is not built by subsidizing passengers but by investing in capabilities. The 8+4+5 package provides fiscal space to do exactly that—if political will is matched with strategic foresight.

Closing

The 8+4+5 stimulus is a bold declaration that the Prabowo administration will not passively await global recovery. For aviation, it could be either jet fuel for transformation or avtur burned wastefully.

If the package is channelled toward certified workforce pipelines, MRO independence, cargo integration, and secondary airport growth, then Indonesian aviation could finally achieve structural resilience. It could shift from being a sector perpetually in crisis management to one that propels national competitiveness and regional leadership.

If, however, the stimulus remains narrowly consumption-focused—boosting passengers without building capacity—then the outcome will be predictable: crowded airports, delayed flights, expensive operations, and yet another cycle of fragility.

The choice is not abstract. It will be made in the allocation of funds, the conditionality of subsidies, and the rigor of monitoring. In aviation, as in flight, course correction must happen early. A small misalignment today leads to a large deviation tomorrow.

Indonesia stands at that juncture. The 8+4+5 package can make aviation the spearhead of national resilience—or leave it as a perennial weak link in the economy. The sky is wide open. The question is: will we take off?